On Thursday August 1, 2024, the DOW dropped 494 points and the next day on Friday, August 2, 2024, the DOW experienced a more significant decline, down another 611 points. According to the so-called experts, the factors contributing to this decline included weaking employment, manufacturing, and construction data, along with a weaker-than-expected jobs report and a climb in the unemployment rate to 4.3%. Maybe an expanded and all out war in the Middle East may have something to do with it…

Freedom or Democracy…The Choice is Ours [1]

Today’s Democratic Party is strongly opposed to freedom. Democracy and Freedom are antithetical concepts. An example of democracy may be represented by two wolves and one lamb deciding what to have for dinner; freedom, on the other hand, is a well-armed lamb contesting the vote. It is the Democrats and democratically controlled cities that tend to go out of their way to restrict the ability of law-abiding citizens to defend themselves—as guaranteed by the Second Amendment—against violent criminals over-running their cities. Maybe the Democrats are more worried that the Second Amendment right to keep and bear Arms, may someday be used against them as explained by the Founders in the Declaration, “whenever any Form of Government becomes destructive [of our inalienable rights to “Life, Liberty, and the Pursuit of Happiness”] it is the Right of the People to alter or to abolish it.”

DRIP… DRIP… YOUR WAY TO REAL WEALTH

Financial Independence has nothing to do with your net worth (assets less liabilities). There are many millionaires who are not financially independent. If they lost their 6-to-7 figure incomes from their jobs or professional careers, many would have to file for bankruptcy. Many millionaires work every day to pay their mortgages on several homes, yachts, and all their other expensive trappings of perceived wealth; they are slaves of the banks, who they pay their mortgages to; they are slaves of government who they pay their Federal and State Income Taxes, Medicare and Social Security Taxes, and the ever-increasing Real Estate Taxes on their lavish homes. If they must work at their jobs or professional careers to maintain their lifestyle, they are not financially independent.

The Supreme Court Rules the Second Amendment is a Second-Class Right Subject to Government Restrictions

The Supreme Court’s decision on June 21, 2024, in U.S. v. Rahimi, overturned the Fifth Circuit Court of Appeals[1] unanimous opinion that 18 U.S.C. §922(g)(8) is unconstitutional because it violates the Second Amendment “right of the people to keep and bear Arms.” This is yet another example of the Supreme Court recently recognizing “a pre-existing right belonging to the American people” that was “codified” in the Second Amendment. Then ignoring “the plain text”— “the right of the people to keep and bear Arms, shall not be infringed”— thereby granting Congress and the Government, at all levels, the ability to pretty much over-regulate this essential right, making it virtually meaningless for too many Americans.

The Supreme Court Majority Admits to Violating Their Oath

The Supreme Court majority once again sided with the Government, violating their oath to support the Constitution. As explained by Justice Bradley (1886), “It is the duty of courts to be watchful for the constitutional rights of the citizens, and against any stealthy encroachments [by Congress and Government].”

The Supreme Court Steps Up but Then Disappoints

The Supreme Court’s decision on the Bump Stock ban “was more of a victory for the rule of law than anything else. The BATF was trying to expand the scope of its regulatory powers well beyond what the law allowed it to do. The Supreme Court, with its current composition, more than any other court in my lifetime, is trying to limit the regulatory powers of government agencies to what the law granted them, not what might be politically popular regulations at any point in time.” Dr. John R. Lott, Jr., Crime Prevention Research Center, Sat 6/15/2024 6:55 AM.

Reasons That Support the Elimination of the U.S. Income Tax

During a private meeting with Republican lawmakers at the Capitol Hill Club last week, former President Donald J. Trump proposed an “all tariff policy” as a solution to eliminate the U.S. income tax. This is a fantastic idea! If implemented properly, the United States would attract businesses from across the globe to incorporate here, reaching near full employment with workers enjoying much higher wages. This action alone would dramatically reduce the Deep States influence and re-establish the American Dream that has all but disappeared in less than four years under the Biden/Harris Administration.

Tips Are Gifts and Should Not Be Taxable to the Recipient

Former President Donald J. Trump vowed to eliminate taxation of income from tips if he were to win a second term in the White House. During a recent rally in Nevada, Trump stated, “For those hotel workers and people that get tips, you’re going to be very happy. Because when I get to office, we are going to not charge taxes on tips.”

When the Market Declines, DRIP Yields Rise

As DRIP Investors, we are buying an income stream—dividends— that will ultimately replace our wages or self-employment income. As Finance Professors Rubin and Spaht stated, “For those investors who adopt ten and fifteen year horizons, the dividend investment [DRIP] strategy will lead to financial independence for life. Regardless of the direction of the market, a constant and growing dividend is a never-ending income stream.”

Update: The Unconstitutional BOI Reporting Requirement That Impacts Small Businesses

As previously stated, beginning January 1, 2024, most small business owners—e.g., corporations, limited partnerships, limited liability companies (LLCs), and business trusts—must report the beneficial owners to FinCEN to include their names, date of birth, address, and a unique identifier number from a recognized issuing jurisdiction (e.g., Passport or Driver’s License), with a photo of that document. Failure to timely comply, timely update, and/or NOT provide the correct information, will result in fines, per violation, of $500 to $10,000 and imprisonment for up to two years. By the time you are notified by FinCEN of your noncompliance, the aggregated penalties may be significantly higher.

Would It Shock You to Know That Average Americans Commit “Three Felonies A Day?”

James Madison, the father of the Constitution, wrote, “It will be of little avail to the people, that the laws are made by men of their own choice, if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood…” Thomas Jefferson warned us, “Law is often but the tyrant’s will, and always so when it violates the right of an individual;” and “The natural progress of things is for liberty to yield and government to gain ground.” We failed to heed the Founders’ warnings…

Social Security, Another Fraud on Americans

The Social Security and Medicare Board of Trustees just came out with their 2024 Annual Report stating that by the end of 2035 the so-called trust funds “will become depleted.” The Board of Trustees are recommending “a broad continuum of policy options that would close or reduce Social Security’s long-term financing shortfall.”

THE ECONOMIC FALLACY OF JOB CREATION BY GOVERNMENT

With the March Jobs Report, President Joe Biden announced that his Administration has created 15 million new jobs since he took office. Never mind that most of those jobs are returning workers from the COVID-19 government mandated shutdowns. In addition, that number would have been substantially higher if the Biden Administration would NOT have implemented their climate change agenda from day one, when they cancelled the Keystone XL Pipeline project and put a moratorium on oil and gas leases in the Artic National Wildlife Refuge. Not to mention the other 95 Executive Orders signed in his first 100 days in office!

The Corporate Income Tax – Another Fraud

President Joe Biden and almost every Democrat says that it is time for Corporations and the Wealthy to pay their fair share of taxes. No one, however, can define what that “fair share of taxes” ought to be. But the real fraud perpetrated against the American people is the idea that corporations pay taxes and should pay more.

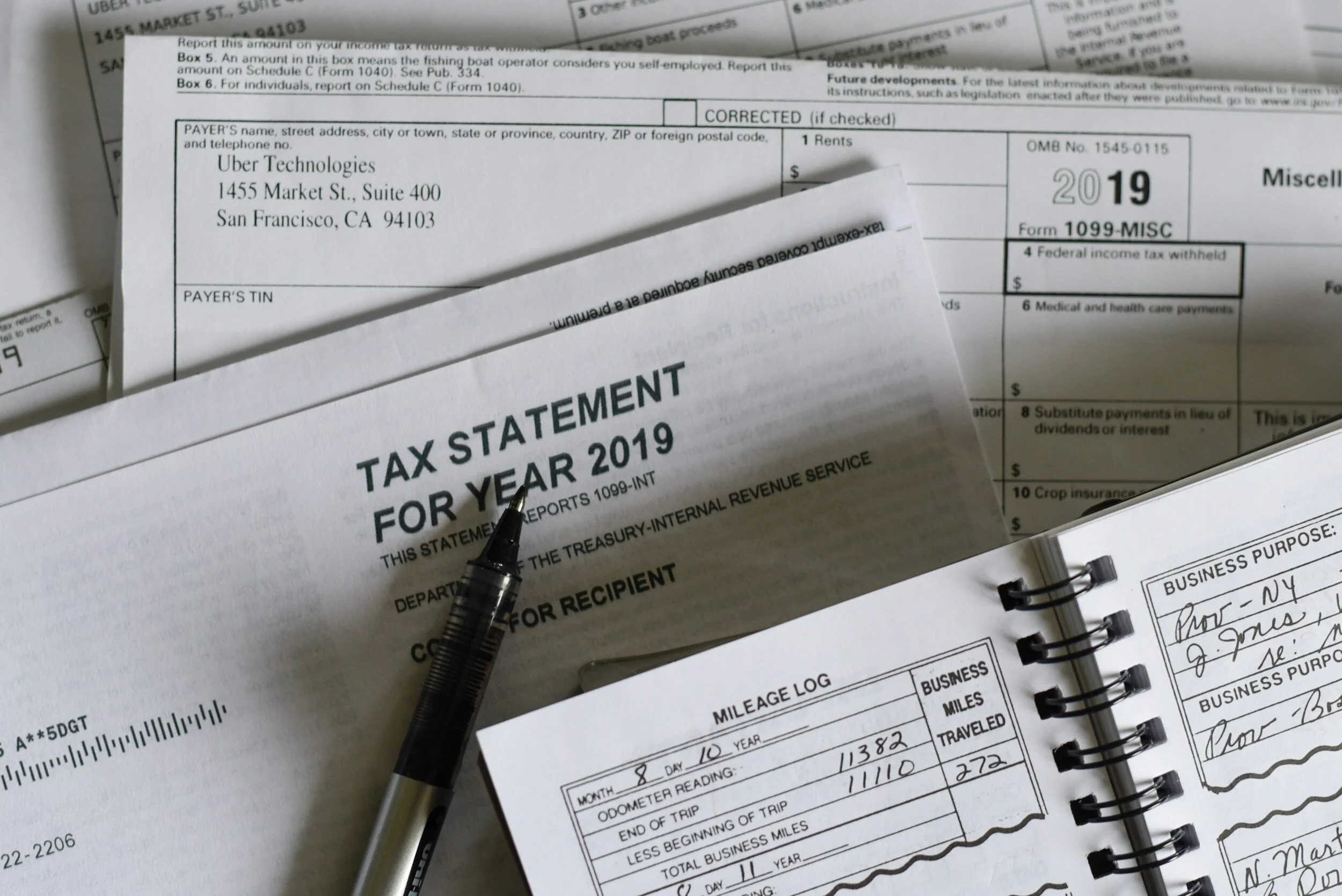

Tax Day – Who Pays and Who Waives Their Rights

Today, April 15, 2024, is the final day where many Americans file their federal income tax returns, waiving their constitutional right under the Fourth Amendment to be secure in their papers and effects, and their Fifth Amendment right not to be compelled to be a witness against themselves. To add insult-to-injury, those that timely filed their returns signed them under penalties of perjury, i.e., if they made a mistake or interpreted the tax laws differently from the IRS, they could end up in prison for 5 years.

The American Conundrum, Democracy or Freedom

According to Guest Essayists for The New York Times, Astra Taylor and Leah Hunt-Hendrix, “These days, we often hear that democracy is on the ballot. And there’s a truth to that: Winning elections is critical, especially as liberal and progressive forces try to fend off radical right-wing movements. But the democratic crisis that our society faces will not be solved by voting alone. We need to do more than defeat Donald Trump and his allies – we need to make cultivating solidarity a national priority. . . Though we rarely speak about it as such, solidarity is a concept as fundamental to democracy as its better-known cousins: equality, freedom and justice.”

The Real Purpose for the Income Tax

In 1945, then Chairman of the New York Federal Reserve Bank of New York, Beardsley Ruml, made a speech to the American Bar Association entitled, Taxes for Revenue are Obsolete. According to Ruml, and understood by those familiar with Austrian Economics, the primary purpose of the federal income tax is to redistribute income and wealth; and “in subsidizing or penalizing various industries and economic groups.”

HOW TO AVOID AN IRS AUDIT: THE INCOME TAX IS A FRAUD AGAINST AMERICANS

April 15th is fast-approaching. The first two things you can do to avoid, or at least minimize, an IRS Audit is (1) extend your tax return, filing it as late as possible on October 15, 2024, and (2) file a paper return. The IRS schedules audits a year in advance, so returns extended and filed later receive less scrutiny. In addition, by filing a paper return, it sits on someone’s desk before it is inputted into the archaic computer system—this may change soon when they can scan paper tax returns—which means your tax return may be given an even lower priority.

THE EIGHTH WONDER OF THE WORLD

Albert Einstein—famous for his equation E=MC2 and the 1921 recipient of the Nobel Prize in Physics, along with being widely regarded as one of the most influential scientists of all time— stated, “compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.”

The New York Civil Fraud Verdict Against Trump is Unconstitutional

Judge Arthur F. Engoron’s decision— ordering President Trump and his two sons to pay more than $450 million and denying them the right to conduct business in New York for several years—is unconstitutional on so many levels. And, to make matters worse, to appeal Engoron’s decision, Trump must deposit the $450 million in escrow or post a bond within 30-days?!

![Freedom or Democracy…The Choice is Ours [1]](https://images.squarespace-cdn.com/content/v1/57c612e75016e157ad8606cc/1722531202180-DK6KO3ZCN0XGRG9K156J/unsplash-image-b_o-yVCVmhk.jpg)