Regarding human society’s conduct and organization, two predominant belief systems exist. The first belief system, derived from the “Old World,” stems from the conviction that government is the grantor and protector of human rights and is responsible for protecting and providing for the poor and down-trodden citizens.[2]“Since history began, all people of the Old World— [except Celts, Irish and the Scots]—have always lived in what is now called ‘a planned economy’. When anyone says, ‘a planned economy,’ he means, control of the human energy used in producing and distributing material goods, by an Authority [in modern times, Government] consisting of a few men, and according to a plan made by those men [e.g., the elected Democratic leaders,] – and enforced by the police [or Government force].”[3}

What the Big Beautiful Bill Will Do for You

The AICPA President and CEO Mark Koziel, CPA, CGMA, stated that the One Big Beautiful Bill Act (BBB) is “a win for millions of businesses, taxpayers, and tax practitioners across the country.” Koziel continued, “No bill is perfect—however, there are many beneficial tax provisions in this bill that I believe support the business community and will help grow our economy. . .”[1]

Political Truth and the Stock Market vs. Technical Truth and DRIPs

Political truth seeks influence while technical truth seeks accuracy. These are two extreme or opposite points on the spectrum. The stock market and the valuation of certain individual stocks are based upon political truths. For example, from time-to-time, some stocks trade at excessively high prices due to market hype and not because of the underlying business fundamentals.

“The Secret History of the Democratic Party”[1]

It was Thomas Jefferson who wrote, “The mass of mankind has not been born with saddles on their backs, nor a favored few booted and spurred, ready to ride them legitimately, by the grace of God.” Yet, since the founding of the Democratic Party by President Andrew Jackson[1] through today, the Democratic Leaders have demonstrated by their actions, that they believe they are the “favored few booted and spurred, ready to ride [the masses] legitimately.”

Great Things Happening at the IRS for Taxpayers

The Trump Administration has proposed a reduction in IRS funding of $2.49 billion for next year, representing a 20% drop from 2025, which would result in the lowest budget for the IRS since 2002. According to the Trump Administration, “the reduced budget would restore IRS as a neutral arbiter that would refrain from using weaponized enforcement or overzealous rules.”

Take Politics Out of the Supreme Court

Supreme Court Justices Sonia Sotomayor and Ketanji Brown Jackson (KBJ) have been critical of the Trump Administration. KBJ—who cannot define a woman because she is not a biologist— recently addressed a judges’ conference in Puerto Rico, where she condemned attacks on the judiciary or rather, criticism of their opinions by the Trump Administration, “warning that they pose a threat to democracy.” She, or whatever her pronoun is, stated:

“The attacks are not random. They seem designed to intimidate those of us who serve in this critical capacity. The threats and harassment are attacks on our democracy, on our system of government. And they ultimately risk undermining our Constitution and the rule of law.”

“They Came for the Jews and I Did Not Speak Out”

After World War II, the prominent German Lutheran Pastor, Martin Niemöller, discussed his complicity about Nazism and “his eventual change of heart:”

“First they came for the socialists, and I did not speak out—because I was not a socialist.

Then they came for the trade unionists, and I did not speak out—because I was not a trade unionist.

Then they came for the Jews, and I did not speak out—because I was not a Jew.

Then they came for me—and there was no one left to speak for me.”

We Have a Choice, Oligarchy or Freedom

Senator Bernie Sanders and Representative Alexandria Ocasio-Cortez (AOC) organized the Fighting Oligarchy Tour which began in February 2025. Their goal appears to oppose oligarchy and corporate influence in U.S. politics. The tour promotes policies like Medicare for ALL, a wealth tax, redistribution, and increased taxes on businesses & corporations. And of course, Bernie and AOC are for open borders and are apathetic towards crime and unsafe cities throughout the United States.

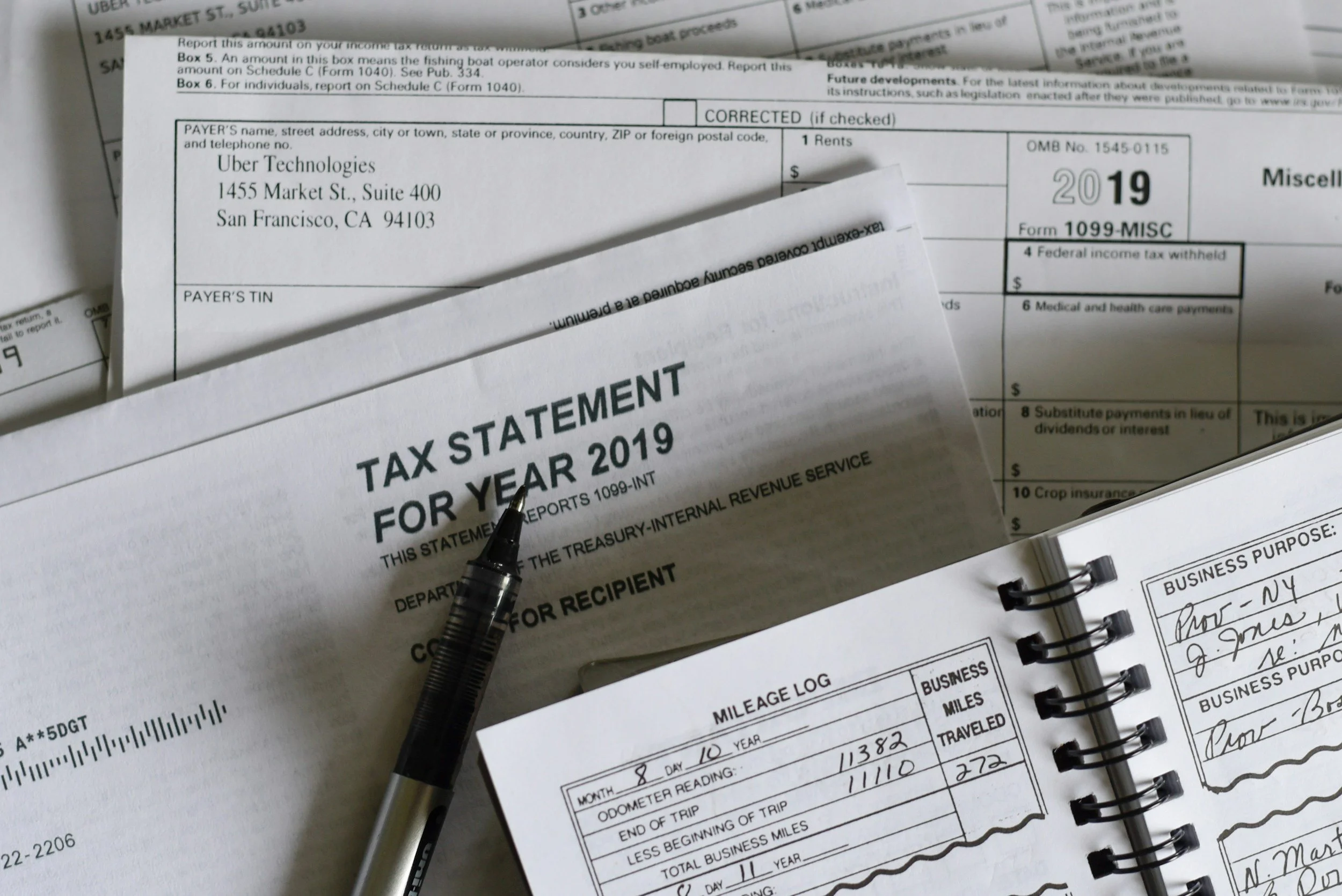

TAX DAY – THE DAY WE WAIVE OUR RIGHTS

We are fast approaching Tax Day, April 15th. On this infamous day each year, every United States citizen and resident, whose gross income exceeds a threshold amount is required to file their individual income tax return with the Internal Revenue Service (our version of the Gestapo), pay any taxes that still may be due, or, at the very least, request an extension of time to file Form 1040.

CRYPTO – DRIPs – FINANCIAL FREEDOM – TAX DAY RECOMMENDATIONS

On Thursday, March 6, 2025, President Trump signed an executive order creating a U.S. Treasury Strategic Reserve for Bitcoin and other cryptocurrencies. The Crypto Reserve will consist of Bitcoin, Ethereum (ETH), Solana (SOL), Cardana (ADA), and Ripple (XRP). For those of you who have been following us since May 8, 2018, you probably have positions in three of the five, ETH, ADA and XRP. If not, never fear, it is NOT too late to acquire at least two, possibly three of the five without breaking the Bank!

TRUMP’S TAX CUTS WILL INCREASE FEDERAL REVENUE

Some members of the House Freedom Caucus are advocating for significant spending cuts to offset the purported costs associated with the proposed tax cuts. It has been proven time and again—going back 2500 years—that reducing the tax burden on people encourages productive activity and trade, resulting in an increase of overall revenue for the Treasury.

The Best Kept Secret to Financial Freedom, Second Edition

Discover the transformative power of financial independence with "The Best Kept Secret to Financial Freedom, Second Edition." This updated and expanded edition delves deeper into the principles and strategies that empower individuals to take control of their financial destinies. Whether you are just starting your financial journey or seeking new ways to augment your wealth, this book offers invaluable insights and actionable steps.

THE CASE FOR TRUMP’S TARIFFS

President Trump wants to “Make America Great Again” and restore the “American Dream” for all Americans, especially our children and grandchildren. To accomplish his objectives, many ideas—radical to most people—will be implemented. Just to name a few, President Trump will significantly reduce regulations, tap our abundant energy resources, use tariffs to negotiate better trade deals, impose reciprocal tariffs to negotiate fair, or ultimately free trade with other countries, and cut federal income taxes.

THE BEST KEPT SECRET TO FINANCIAL FREEDOM AND GREAT BUSINESSES TO BUY NOW

Are you ready to become wealthy and financially independent? Would you like to ensure that you maintain your financial freedom? Would you enjoy seeing your children and grandchildren obtain financial freedom early in their lives, no matter what their career choice? And finally, would you find satisfaction in the thought of your parents retiring without worrying that they may outlive their money?

URGENT - THE IMPENDING BOI REPORTING REQUIREMENTS NEGATIVELY IMPACTS SMALL BUSINESS

The unconstitutional regulatory environment has expanded exponentially under the Biden-Harris Administration resulting in higher prices for goods and services, supply-chain shortages, less competition, along with the bankruptcy and closing of many small businesses. If you want this government intrusion to be curtailed, vote for former President Donald J. Trump and ALL Republicans on Tuesday, November 5, 2024!

WANT TO ELIMINATE THE INCOME TAX – VOTE TRUMP!

On Thursday, October 24, 2024, The New York Times wrote a story with the headline, “Trump Flirts with the Ultimate Tax Cut: No Income Taxes at All.” On June 19, 2024, I wrote a blog titled, Reasons That Support the Elimination of the U.S. Income Tax, which supports former President Trump’s position; and on October 20, 2024, I discussed Trump’s Tariff Strategy. Both blogs are available at www.JeffersonianGroup.com and are must reads to counter the lamestream media’s criticism of Trump’s proposal.

TRUMP’S TARIFF STRATEGY

From 1776 to 1913, the year the Sixteenth Amendment and the federal income tax came into being, the source of federal revenue was from the collection of excise taxes and customs duties or tariffs. There was no income tax, no tax on corporations, and no payroll taxes. To help finance the Civil War, there was a temporary federal income tax of 3% that impacted less than 5% of the population. The first federal income tax occurred under President Abraham Lincoln, and it was repealed in 1872.

THE CASE AGAINST OPEN BORDERS

The Democrats want our borders wide open! Democrats believe that by allowing into our country countless numbers of illegal aliens, it will be a surefire route to gain more votes in hopes of acquiring an excessive amount of political power. Their endgame is to make sure Republicans never again control the Executive Branch, the House or the Senate. The Democrats will then be able to institute their utopian ideology of socialism—which has never worked any time in recorded history—and, for all practical purposes, they would do away with the First and Second Amendments, along with the Fourth and Fifth Amendments. Basically, they will gut the Bill of Rights and eviscerate the American Dream.

LET’S GET TO KNOW THE REAL KAMALA HARRIS

In Profiles in Corruption, Peter Schweizer’s investigative reporting identified eight progressives that used their “political power to enrich” their family; “tilting the scales of justice for the benefit of friends; steering government contracts to friends and family; or using the machinery of [their] office to serve [their] interests rather than those of the people [they] are supposed to represent.” Included among these eight corrupt progressives is Vice President Kamala Harris.

BEWARE of the KAMALA HARRIS ECONOMIC PLAN

President Joe Biden stated that he ran for president “to fundamentally change things” and “to build an economy from the bottom up and the middle out, not from the top down [often referred to negatively as “trickle down” by the Democrats].” Vice-President Harris has emphatically told the mainstream press that she was the last person in the room with Joe Biden and proud of ALL the decisions and policies put forth by the Biden-Harris Administration.

![“The Secret History of the Democratic Party”[1]](https://images.squarespace-cdn.com/content/v1/57c612e75016e157ad8606cc/1750163288994-WSH2J7BMLIRS2ZAK2GCK/unsplash-image-nlmq5jC9Slo.jpg)